Understanding an Order Block in Trading is a core pillar of institutional trading because it reveals the intent of major players. While retail traders often focus on lagging indicators, professional analysts look for these supply and demand zones where price was manipulated to collect liquidity. Consequently, an Order Block in Trading provides a high-probability entry point that aligns with the directional bias of banks and hedge funds. Furthermore, this 2,500+ word deep dive into smart money concepts will equip you with the tools to find an Order Block in Trading with surgical precision.

Defining the Order Block in Trading from an Institutional Perspective

To define an Order Block in Trading, one must look at the behavior of institutional market participants. These entities cannot enter their entire position at once without causing massive slippage; therefore, they break their orders into smaller blocks. An Order Block in Trading is essentially the last candle of the opposite color before a strong impulsive move that breaks market structure.

The Mechanics Behind an Institutional Order Block

The mechanics of an institutional Order Block in Trading involve the process of liquidity accumulation. Before a large move upward, institutions will often sell to induce retail traders into short positions, creating the necessary buy-side liquidity. This selling creates a bearish candle, but the subsequent massive buy orders overwhelm the market, leaving an Order Block in Trading behind. As a result, when price eventually returns to this specific candle, the remaining institutional orders are filled, leading to a sharp reversal.

How Smart Money Concepts Distinguish an Order Block in Trading from Retail Patterns

Smart money concepts distinguish an Order Block in Trading from retail patterns by focusing on intent rather than just shape. For instance, a retail trader might see a simple support level, whereas a professional identifies an Order Block in Trading backed by an institutional footprint. Moreover, these blocks are valid only if they result in a displacement that shifts the market trend. Therefore, an Order Block in Trading is a refined version of supply and demand that requires specific structural confirmation to be considered valid.

Why Professional Traders Seek to Identify Order Blocks

Professional traders seek to identify order blocks because these zones offer the most favorable risk-to-reward ratios in the market. By entering at an Order Block in Trading, a trader can place a tight stop loss just outside the institutional zone. Additionally, because the Order Block in Trading originates from heavy institutional buying or selling, the price usually reacts quickly once the zone is retested.

The Role of an Order Block in Trading for Market Liquidity

An Order Block in Trading serves as a magnet for market liquidity. Institutions need to “mitigate” their previous loss-making positions that were used to bait retail traders. Consequently, price is often drawn back to an Order Block in Trading to close out those initial hedging orders. This return to the Order Block in Trading provides the necessary liquidity for the next phase of the market trend.

Comparing Supply and Demand Zones vs. a True Order Block in Trading

While every Order Block in Trading is technically a supply or demand zone, not every zone is an order block. A traditional zone might be broad and loosely defined, whereas an Order Block in Trading is a very specific candle or price range. Furthermore, the Order Block in Trading must be accompanied by a “Fair Value Gap” to confirm that the move was institutional in nature.

| Criteria | Traditional Supply/Demand Zones | Institutional Order Blocks |

|---|---|---|

| Definition | Broad areas of price rejection | Specific “last candle” before impulse |

| Volume Profile | Often moderate or inconsistent | High volume with clear displacement |

| Price Displacement | Not always required | Mandatory for validation |

| Timeframe Relevance | Effective on all timeframes | Highest probability on H4 and Daily |

| Reliability | Moderate | High (with Smart Money confirmation) |

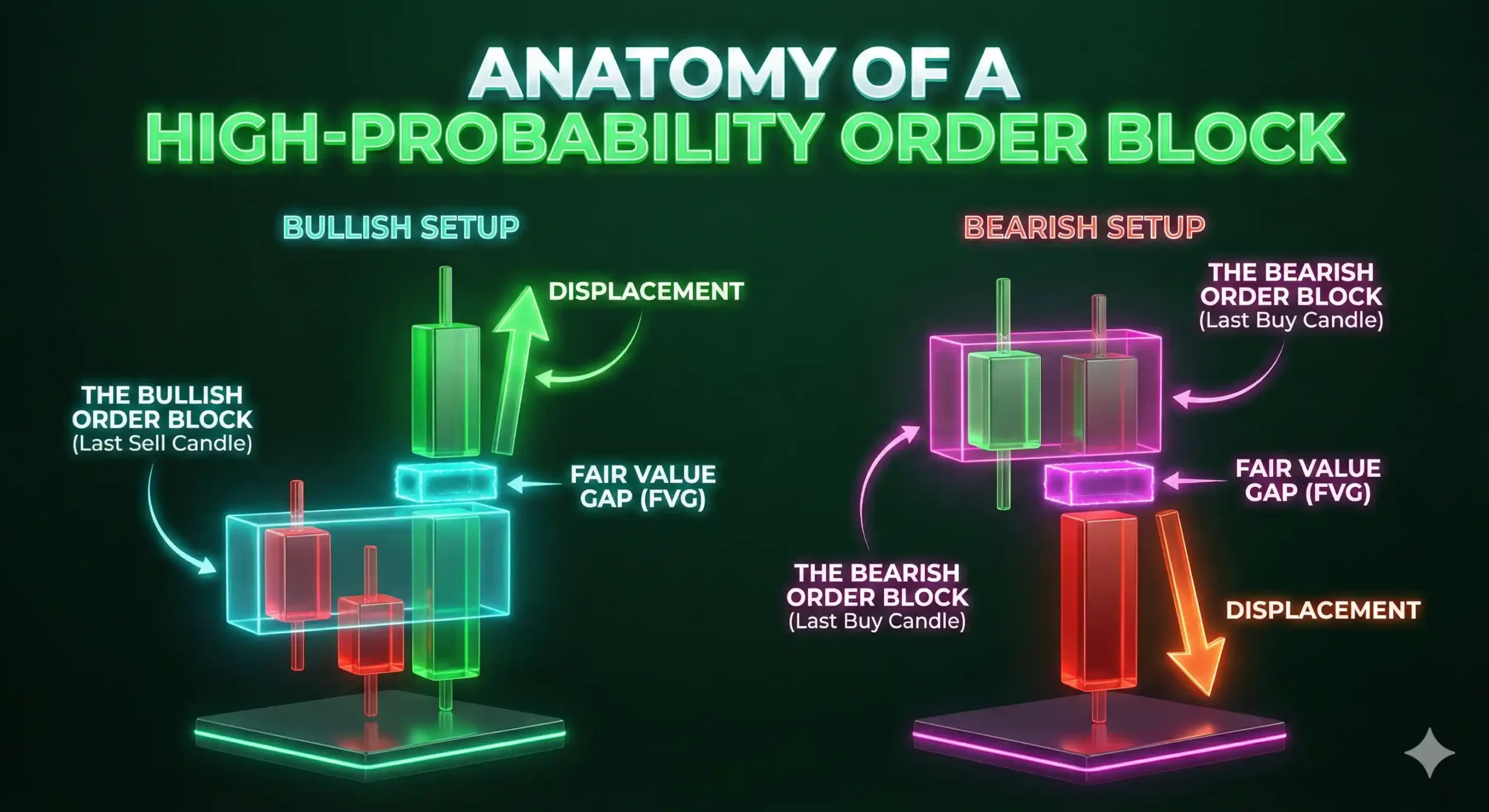

The Anatomy of a High-Probability Order Block in Trading

A high-probability Order Block in Trading possesses specific anatomical features that separate it from random price action. Without these characteristics, a candle is simply a part of the noise. To successfully utilize an order block strategy, you must look for clear displacement and a break in the previous market structure.

Characteristics of a Valid Bullish Order Block

A bullish order block is the last bearish candle before a strong bullish impulse that breaks a previous swing high. Specifically, this candle represents where institutions were selling to build their buy positions. For an Order Block in Trading to be bullish, it must be followed by a series of aggressive green candles. Additionally, the Order Block in Trading should ideally sit at a discount level within the overall price range.

Characteristics of a Valid Bearish Order Block

Conversely, a bearish order block is the last bullish candle before a significant downward move. This candle shows where smart money was buying to trap retail long traders before dumping the price. When you identify order blocks of this nature, you look for a sharp break below the previous swing low. Therefore, the Order Block in Trading acts as a ceiling that price is unlikely to break upon its first return.

The Importance of Displacement and Fair Value Gaps in an Order Block Strategy

Displacement is the “engine” of a successful order block strategy. If the price moves away from the Order Block in Trading slowly, it suggests that institutions are not behind the move. However, if the move is rapid and leaves a Fair Value Gap (an imbalance in price), it confirms the Order Block in Trading. Consequently, an Order Block in Trading followed by an imbalance is significantly more likely to hold during a retest.

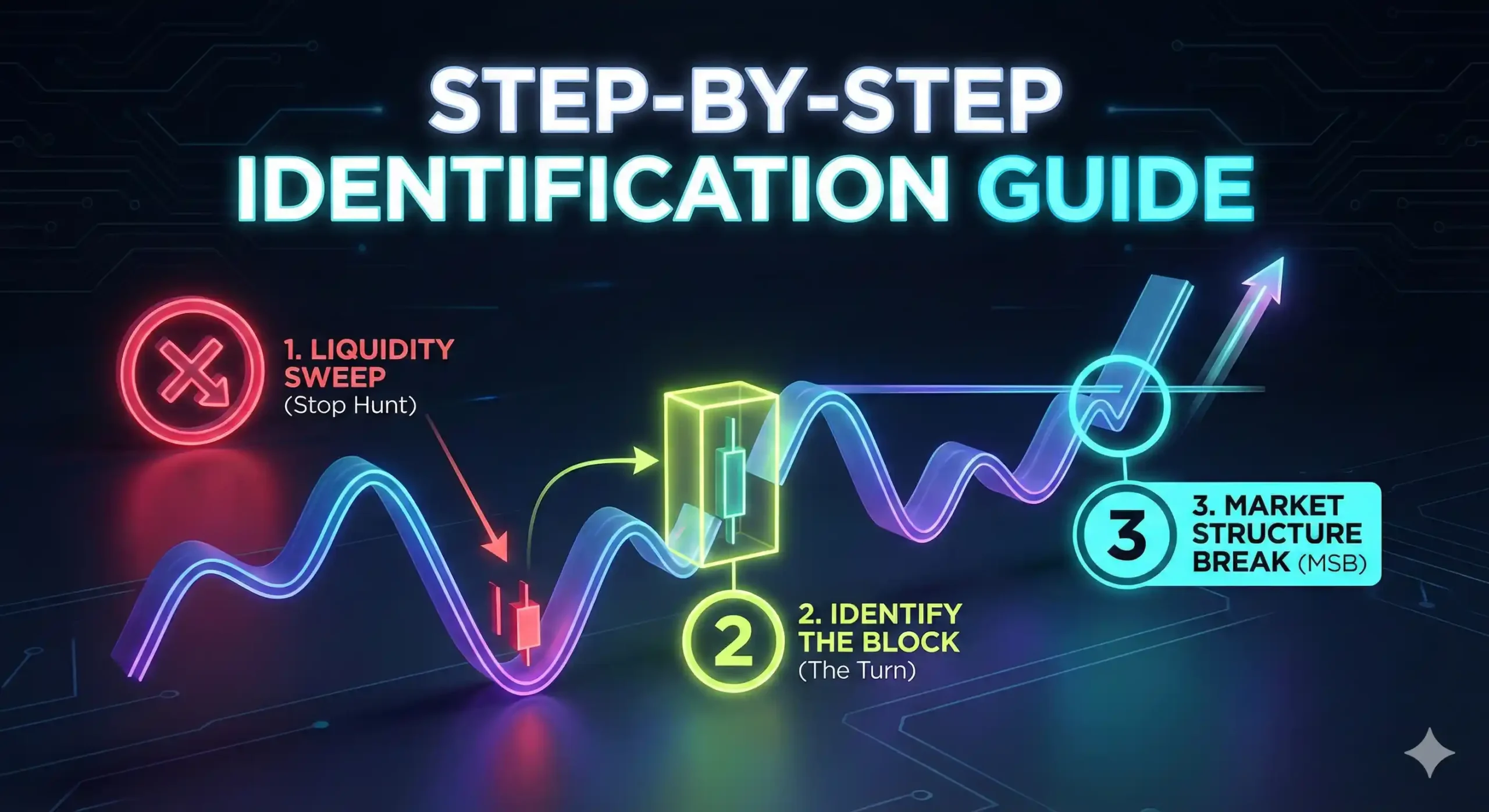

Step-by-Step Guide: How to Identify Order Blocks Like a Pro

To identify order blocks effectively, you must follow a systematic process that removes subjectivity.

Step 1: Finding the Liquidity Sweep Before the Order Block in Trading Forms

The first step to find an Order Block in Trading is to look for a liquidity sweep. This occurs when price takes out a previous high or low to trigger stop losses. This move provides the liquidity for institutions to enter their real positions. Once the sweep is finished, the Order Block in Trading begins to form as the price reverses direction aggressively.

Which app is better for trading in the UAE? Full Guide for Traders

Step 2: Spotting the “Last Candle” Before the Impulse Move

After the liquidity sweep, you must identify the exact candle that initiated the move. This “last candle” is the heart of the Order Block in Trading. In a bullish scenario, it is the lowest down-closed candle; in a bearish scenario, it is the highest up-closed candle. This specific Order Block in Trading will be your area of interest for future trade entries.

Step 3: Using Market Structure Breaks to Confirm an Institutional Order Block

Validation of an Order Block in Trading requires a Market Structure Break (MSB). If the price does not break a previous structural point, the Order Block in Trading is likely a “trap.” Only when price closes above a swing high (for bullish) or below a swing low (for bearish) does the Order Block in Trading become a high-probability zone. Thus, the MSB is the final confirmation in any robust order block strategy.

Implementing a Robust Order Block Strategy

Successfully executing an order block strategy requires more than just identification; it requires discipline in entry and exit. You must wait for price to return to the Order Block in Trading before taking any action. This “return to order block” is where the highest precision entries are found, as it aligns your trade with the institutional flow.

Entry Techniques Using a Refined Order Block Strategy

When price returns to an Order Block in Trading, you can enter using a limit order at the candle’s open or 50% equilibrium. Entering at the 50% mark of the Order Block in Trading often provides an even better risk-to-reward ratio. However, some traders prefer a direct entry at the start of the Order Block in Trading to ensure they do not miss the move. Regardless of the choice, an Order Block in Trading provides a clear, logical entry point.

Setting Stop Losses and Take Profits Around an Order Block in Trading

A stop loss should always be placed just beyond the wick of the Order Block in Trading. If price trades through the Order Block in Trading, the institutional thesis is invalidated, and you should exit. For take profits, traders typically target the next available liquidity pool or the opposing Order Block in Trading. This ensures that your order block strategy captures the meat of the institutional move.

Combining an Order Block Strategy with Multi-Timeframe Analysis

To increase your success rate, combine your order block strategy with multi-timeframe analysis. For example, identify a major Order Block in Trading on the Daily chart and look for entries on the 15-minute chart. This “top-down” approach ensures that you are trading an Order Block in Trading that has significant weight behind it. Consequently, a lower-timeframe Order Block in Trading that aligns with a higher-timeframe zone is a “gold mine” for traders.

Advanced Techniques to Identify Order Blocks in Volatile Markets

In volatile markets, standard zones may be bypassed, requiring more advanced methods to identify order blocks. Advanced traders look for specific variations like mitigation blocks or breakers. Understanding these nuances allows you to trade an Order Block in Trading even when the initial setup seems to have failed.

Distinguishing Between a Mitigation Block and a Standard Order Block in Trading

A mitigation block occurs when an Order Block in Trading fails to lead to a new high or low but is later used as a turning point. Unlike a standard Order Block in Trading, a mitigation block does not require a liquidity sweep. However, it still represents a point where institutions are exiting orders. Therefore, identifying this type of Order Block in Trading can help you find entries in trending markets that lack deep retracements.

Refining an Institutional Order Block on Lower Timeframes for Precision Entries

Precision is the hallmark of a professional order block strategy. By zooming in, you can often find a smaller Order Block in Trading inside a larger one. This “nesting” technique allows for incredibly small stop losses. For instance, a 1-hour Order Block in Trading might contain a 5-minute block that offers a 1:10 risk-to-reward ratio.

| Block Type | Market Condition | Entry Logic |

|---|---|---|

| Standard Order Block | Trending | Trade the first retest of the zone |

| Breaker Block | Reversal | Trade the zone after it is “broken” and flipped |

| Mitigation Block | Weak Trend | Trade the zone that failed to sweep liquidity |

| Reclaim Block | Strong Trend | Trade a previously used block that holds again |

Common Pitfalls When You Identify Order Blocks

Even the best Order Block in Trading can fail if the context is wrong. Many traders fail because they identify order blocks in isolation without looking at the broader market environment. One major pitfall is ignoring the “higher timeframe narrative” which often overrides a local Order Block in Trading.

Why an Order Block in Trading Fails During High-Impact News

High-impact news can cause price to slice right through a valid Order Block in Trading. During news events, the massive influx of volatility can ignore technical levels as institutions clear out all available liquidity. Therefore, an Order Block in Trading should be approached with caution or avoided entirely during NFP or FOMC releases. Moreover, news often serves to reach an Order Block in Trading on a much higher timeframe than the one you are currently viewing.

Avoiding “Ghost” Order Blocks in Low-Volume Environments

In low-volume environments, such as the Asian session for some pairs, “ghost” order blocks often form. These look like a valid Order Block in Trading but lack the institutional volume to sustain a move. To avoid these, only identify order blocks that form during high-volume sessions like London or New York. An Order Block in Trading created during a dead market is rarely reliable for a significant move.

FAQ Regarding the Order Block in Trading

What is the most accurate timeframe to identify order blocks?

The most accurate timeframes to identify order blocks are the Daily, H4, and H1 charts. These higher timeframes represent significant institutional positioning. While an Order Block in Trading works on any timeframe, lower timeframes are prone to more noise and “false” signals.

Is a Bullish Order Block the same as a Support Level?

No, a bullish order block is not the same as a standard support level. While support is a general area where price has bounced, an Order Block in Trading is a specific candle where institutional buying occurred after a liquidity sweep. Therefore, an Order Block in Trading is a much more precise and high-probability level.

How do I incorporate an Order Block Strategy into Day Trading?

To incorporate an order block strategy into day trading, start by identifying the daily bias. Once you have a direction, look for an Order Block in Trading on the 15-minute or 5-minute chart during the London or New York session. Ensure there is a market structure break and a fair value gap for the best results.

Can an Order Block in Trading be used for Forex and Crypto?

Yes, an Order Block in Trading can be used effectively across all liquid markets, including Forex, Crypto, and Stocks. Because the concept is based on the behavior of large institutions, it applies wherever there is significant capital moving the market. In Crypto, an Order Block in Trading is particularly effective due to the high frequency of liquidity sweeps.

Final Thoughts on Mastering the Order Block in Trading for Consistent Profits

Mastering the Order Block in Trading is a journey from seeing simple candles to understanding market intent. As we have explored, a valid Order Block in Trading requires a liquidity sweep, displacement, and a break in market structure. By following a strict order block strategy, you align your trades with the most powerful forces in the financial world.

Success requires extreme patience when waiting for price to return to your selected institutional Order Block in Trading.

A stock market enthusiast with hands-on experience in trading. He writes simple and practical content to help people understand the market better.